While holiday stockings are being with hung with care, advertisers are developing their marketing strategy and media plans for Super Bowl 50.

AdParlor just surveyed 400 professionals at leading brands and agencies to understand how they’re planning campaigns around the Big Game—one of the largest advertising events in the world. Last year, more than 114 million people in the U.S. watched the game, leading to this year’s $5 million price tag for a 30-second spot.

Crashing the Super Bowl is the New Play

More than 60% of our survey respondents plan to advertise around the Super Bowl. Of those, a whopping 33% will advertise online only. This is due, in part, to the cost of in-game ads. But another reason? Savvy advertisers know they can opt-out of TV spots but still take advantage of the traffic the Super Bowl generates. Last year, viewers watched Super Bowl ads 300 million times online; on YouTube alone, that equates to over 6.3 million hours of viewing.

Advertisers are Running Cross-Channel Campaigns

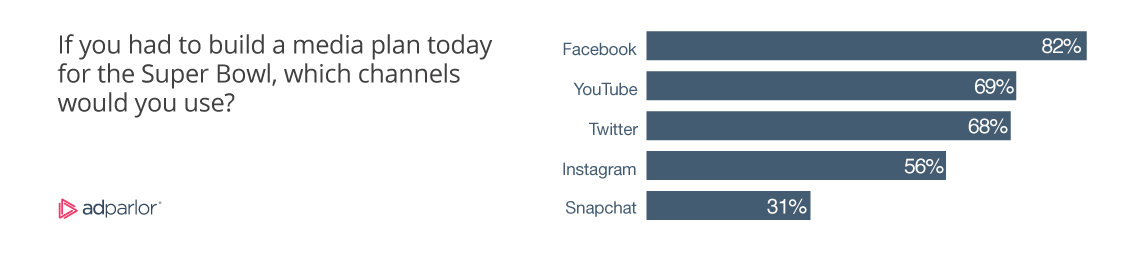

We asked which social media channels advertisers were planning to use for the Super Bowl this year; the answers were vastly different than years past.

The Bottom Line

Advertisers are not opting for a single social platform, but are taking a multi-channel approach, with Facebook is definitely a key part of the marketing mix, followed by YouTube and Twitter. You should also expect to see more activity on Instagram and upstart Snapchat this year—and likely going forward.

Choosing Differently for Gender Targeting

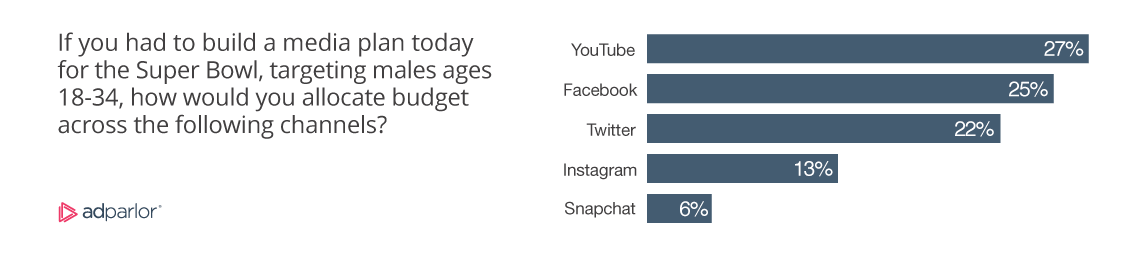

We asked advertisers where they plan to spend the majority of their online marketing budgets when targeting 18-34 males. Against this target, YouTube and Facebook dominate, followed closely by Twitter.

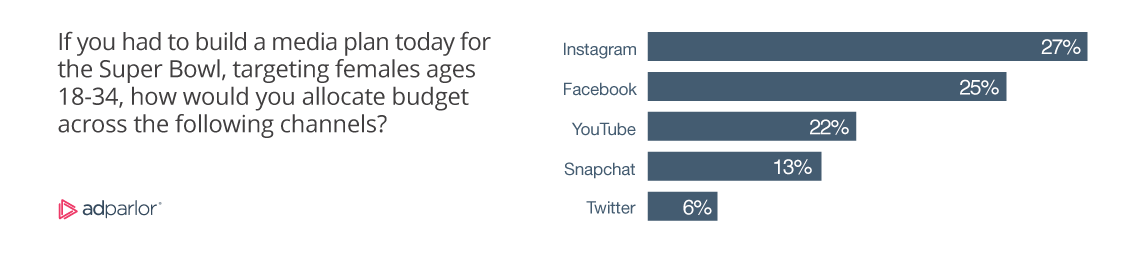

Not surprisingly, the female target skews more toward Instagram and Facebook.

Takeaways

We at AdParlor find these results encouraging. Marketers understanding the social video ecosystem is evolving and becoming increasingly fragmented. Advertisers are choosing a more holistic approach to take advantage of the best aspects of each platform:

YouTube: Has tremendous views and completion rates.

- Last year, it was the dominant platform for views with 234 million—which is twice as many views as Facebook, according to Mashable.

- YouTube has higher completion rates and lower CPV—and a view is also only measured when a viewer watches at least 30 seconds of a spot.

- Ads are searchable, enabling a viewer to quickly find a video. Ads can also be archived, another added benefit for brands.

One caution: advertisers should use YouTube, but target down to the URL level, not just channel. Advertisers should not buy YouTube based on keywords, cookies or channels. Targeting at this aggregate level can present brand safety issues as well as less-than-ideal targeting.

Facebook: Stronger engagement, shares and clickthrough rates

- Last year, Facebook had fewer views but double the share rate of YouTube.

- It also had six-times the engagement rate, according to Mashable.

- Compared to YouTube, Facebook enables greater conversions and clickthrough.

One big opportunity: Facebook and Instagram utilize the same targeting approach and data. From the campaigns we’ve run for clients, the overlap between Facebook and Instagram is much greater than many might think. Optimizing for both using a single interface is both efficient and effective.

Twitter: While not as dominant as YouTube and Facebook, Twitter is critical part of the media mix, especially in the Super Bowl’s second-screen situation. Last year’s game was the most tweeted @superbowl ever with over 28.4 million tweets during the broadcast. Expect to break the 30 million barrier on February 7.

One big opportunity: When advertisers set up their war rooms, they should not just be looking at how to “participate” but how to also optimize placement—new memes, videos, clips are hatching constantly. Making sure to take advantage of that content.

Expanding the Pie—Not a Zero-Sum Game

It’s a mistake to think that these media choices are binary; it’s actually quite the contrary. Last year, YouTube’s share of video views for Super Bowl commercials dropped 20% points to 74%, but the platform’s total number of views increased from 200 million to 350 million year over year. This is not surprising, as digital generations increasingly look to online sources. As a result, CBS will run ads online and on TV simultaneously for the first time.

Mobile: the Trump Card

All of these social video platforms—YouTube, Facebook, Twitter, Instagram and Snapchat—are ideal cross-device platforms that offer optimal mobile experiences. In a crowded Super Bowl party, viewers might have to strain to see the TV, but their phones are always at arm’s length!