Facebook has come a long way in the past two years as a website, as a platform for communication, and as a revenue generating business. As the CEO at AdParlor, I have seen the Facebook Ad platform gradually evolve and improve. I wanted to take a step back and look at how far Facebook has come, and their future revenue growth potential.

We will dive into the three key areas of internet advertising – mobile, display, and search. Of these – Facebook has only begun to capitalize on mobile, but has been laying out an interesting framework in the other two areas.

Mobile

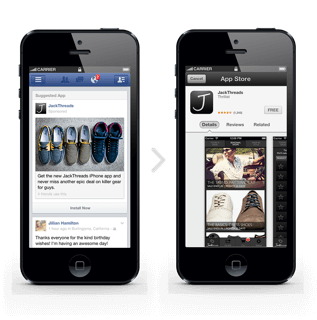

Facebook’s efforts to monetize the 751 Million Mobile monthly active users world-wide will prove to be a key revenue driver in the coming quarters. According to comScore, during April 2013 in the US, the average Facebook mobile user spent 12 hours and 38 minutes on either the Facebook App or the mobile site. The good news for Facebook is that mobile is working extremely well. In addition to impressive results with their existing ad units on mobile – such as Page Like ads and Page post ads, Facebook launched a new ad unit in August 2012 – the mobile app install ad unit.

It is a fairly large ad unit that appears in News Feed asking the user to install a mobile application. When clicking on this ad unit, the user is taken directly to the iOS app store or Google Play app store depending on the device they are on. Facebook has even built an SDK that developers can easily include in their application that allows them to see the number of installs that these ads are delivering (as opposed to just impressions and clicks).

Already – this ad unit has been a success, and in Q1 Facebook reported that this ad unit drove 25 million installs. Looking at an average rate of approximately $2.50 / install across countries – that means that the mobile app install ad unit accounted for an estimated $62.5 million of Facebook’s Q1 revenue! The even better news is that Facebook continued to iterate quickly throughout Q1 and added the ability to target by iOS version, Android device, mobile users connected to a WiFi network (great when promoting large apps), and the ability to design custom creative. This constant innovation has meant that the ad unit continued to perform better month over month.

When we look at key indicator metrics such as the CPM rate and CTR for AdParlor clients – we can see the trend in Q1 – followed by some normalization in Q2. In March, we saw a peak CTR of 1.86% and a CPM rate just shy of $6.00. More recently in June, we saw a CTR of 1.15% and a CPM of $3.03. In April, we analyzed over 450,000 mobile app installs AdParlor delivered across verticals – and we saw an average Cost-per-Install (CPI) of $2.05.

Facebook will continue to innovate with their mobile ad products, and I predict this will result in strong revenue growth over the next few quarters and over the next few years. In fact, eMarketer predicts that by 2015, almost half of all US ad spend on Facebook will be on mobile.

Display

One of the areas in which I predicted we would see a jump in Facebook’s revenue would be through the launch of an external display network. In theory, Facebook would build a display network by serving ads across all web sites that are “connected to Facebook.” This initiative would integrate social and contextual targeting, resulting in a more relevant and effective advertisement. However, Facebook has not yet shown any signs of launching such a display network outside of Facebook.com.

Taking a step back, Facebook has some good reasons to hold off for now. First – Facebook already has at its disposal an enormous amount of display impressions. According to comscore, US Facebook users spent an average of 5 hours and 43 minutes on the Desktop site in April 2013. Taking this usage metric as a baseline, multiplying it by a conservative ad impression per minute estimate, and the 1.1 Billion desktop monthly active users world-wide – Facebook serves Trillions of display ad impressions a month on its site. With this volume of inventory available, it may not be necessary yet to go after impressions outside of Facebook.com. There is more than enough supply available to meet its advertiser’s demands at a fair market price. Additionally, with Ads served on Facebook.com, Facebook keeps all the revenue generated. Serving ads on third-party sites means that a significant portion of the revenue earned from these ads would have to be paid out to the sites/publishers displaying these ads.

That being said, building a display network clearly offers significant reach and revenue growth potential for Facebook. While the primary reason for the Atlas acquisition was to improve attribution, an extra hidden benefit of the Atlas acquisition is that Facebook acquired a platform to deliver display advertising across the web. The Atlas acquisition lessens many of the complexities and technical challenges around building a display network – and Facebook will surely leverage this when the time is right. I believe Facebook is still at least 1-2 years away from launching an external display ad network.

Search & Intent

Facebook has an opportunity and the unique ability to build a search engine that brings together social context and deep intent. Facebook continues to build its social graph of what users (and their friends) like – generating over 4.5 billion likes every day. However, they have yet to leverage this data into a native search engine. Facebook has been gradually improving Graph Search and just recently decided to roll it out to all US users. They have made improvements in search speed and accuracy. However – Facebook’s current Graph Search solution along with the Web Search integration with Bing is simply not a compelling enough product to get users to switch away from their existing search provider. In fact, Facebook Sheryl Sandberg has said directly that “Graph Search isn’t Web search. We aren’t duplicating what Bing does and what Google does, but rather we are making things easier for people to find on Facebook”

Two years ago – I strongly felt that Facebook had to build a native search engine in order to capture intent and the advertising budgets that come with it. However, Facebook has made significant strides over the past year to capture user intent without requiring them to specifically search. Facebook continues to roll-out products such as custom audiences, partner categories and FBX – and they are leveraging these tools to get advertising in front of users who have purchase intent. This means that Facebook is attracting more and more spend from advertisers who are not just looking for branding – but also looking for measurable ROI.

Custom audiences allows a brand to take their existing CRM data (phone numbers, email addresses, Facebook user ID’s, Mobile App user ID’s) and specifically target those users on Facebook. This means that companies can be super intelligent about their targeting. In theory, if I make a long distance phone call from my AT&T phone and don’t have a long distance plan, very soon after, AT&T should be able to serve me a Facebook ad with a great long distance plan offer (assuming I have my cell phone number entered in my Facebook profile and AT&T is leveraging custom audiences in an efficient way)

Utilizing 3rd party data, Partner Categories was introduced through a partnership with datalogix, acxiom, and epsilon – and provides US advertisers the ability to target users in over 400 very interesting categories. For example, based on transaction level data of 1,200 US retailers – advertisers can target “People who are likely to buy men’s jeans”. Based on recent customer purchases – advertisers can target “People who are receptive to online higher mortgage offers”.

FBX allows advertisers to place cookies along their web site, and then re-target those users on Facebook based on their browsing activity. In theory, if I looked at an item on Amazon.com but didn’t pull the trigger on a purchase, I should see an ad for that exact product on Facebook.com. Clicking on that ad should take me right back to the correct page within the purchase funnel.

A great example of how Facebook is able to drive direct ROI for a large advertiser is with MGM Resorts International. Leveraging Custom Audience targeting, MGM saw a 5x ROI while FBX helped them see a 15x ROI. Without having to build a search engine, the right Facebook tools enabled MGM to get advertising in front of users who were looking to book a hotel room. An increasing number of advertisers are seeing such success – driving measurable ROI on their ad spend – by leveraging the latest and greatest Facebook Ad products.

Whether or not Facebook builds a native search engine, they are making steady progress in delivering advertising to users with purchase intent. This is a huge step forward for them in terms of unlocking ‘performance based’ revenue.

Bringing it all together

Facebook has made impressive leaps in its transition to being a mobile-first company – and they have proven that they can drive significant revenue from mobile. They have yet to launch an external display ad network, but certainly have the plumbing in place to do so. And while Facebook may or may not launch a native search engine, they are proving that they can get in front of a user at the point of purchase intent. While it is difficult to predict how Facebook revenue will grow without knowing how far and how aggressively they will go in each of these categories, it is clear that they are making progress in all the right places.

Fortunately for Facebook – they have a massive database of genuine information on users, their friends, and what they like. This extra dimension gives Facebook a leg up and will allow them to continue building more compelling and effective advertising products.