Meet the new kid on the block, Threads

Earlier this month, Instagram released its new competitor to Twitter, Threads. It set records for new signups, surpassing 100 million users in a matter of days. ChatGPT (previously crowned as the fastest-growing application in history) took two months to hit that same mark. Not only were users signing up at lightning speed, they were posting and engaging within the platform as well. Just one day after launch, it was reported that there were already more than 95 million posts and 190 million likes shared on the app. The question on everyone’s mind, though, is how long (or if) the momentum will continue. There are reports that daily active users and time spent have decreased since launch.

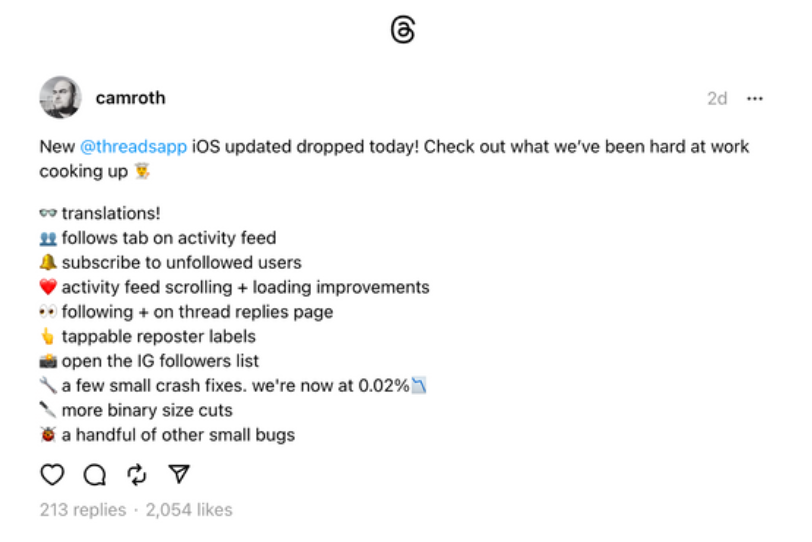

However, with a recent iOS update on July 18th (right) and more on the horizon, Threads is trying to prove it’s here to stay. Not to mention, there’s a lot of untapped advertising potential on the platform as advertisers wait patiently.

AdParlor POV:

While we could argue no other social media platform has seen that kind of success that quickly, Threads is still in its infancy. We’re anxiously watching to see if it captures the same cultural cachet that Twitter once did. Threads may be more in position to capture users who were not already active or as familiar with Twitter. While Instagram isn’t specifically trying to replace Twitter, it could end up being the place people go for a conversation-based social media platform.

And while Meta “couldn’t be more psyched” about how the launch week has gone, “We don’t even know if this thing is retentive yet,” the head of Instagram, Adam Mosseri, said. Zuckerberg has also mentioned it will be a while until sponsored ads are a thing on the platform, however, Hulu and creator Adam Rose appear to have been the platform’s first ad deal shortly after the platform launched. Rest assured, when there’s an opportunity to Beta test, our community will be the first to know!

Just for Fun

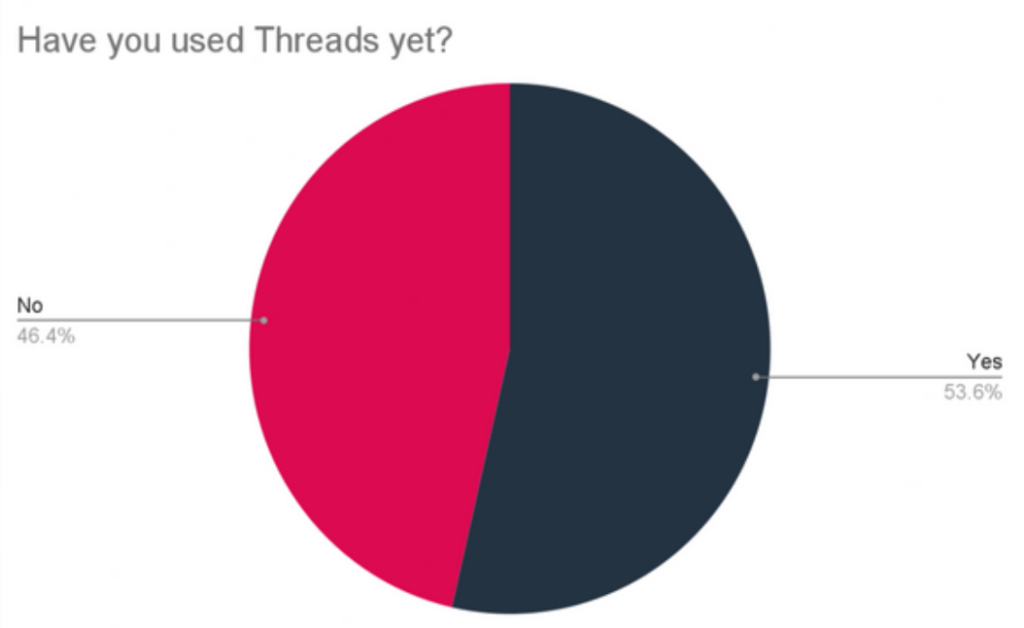

We took a team poll to see how many of us had used or are using Threads and the results are in! Overall, the sentiment has been pretty positive as well.

“We don’t even know if this thing is retentive yet,”

– Adam Mosseri, Head of Instagram

Allow me to reintroduce myself, my name is X

In a Tweet (or should we say X?) early on July 24, it was confirmed by Elon Musk that Twitter is transforming into X. The site’s former bird logo has now been replaced by an interim new X logo and X.com officially redirects to Twitter.com. These developments signal a change to Musk’s “everything app” that he originally envisioned shortly after purchasing Twitter for $44 billion in November. CEO Linda Yaccarino wrote in a post Sunday that X will be “centered in audio, video, messaging, payments/banking.” She also added that the platform will be powered by artificial intelligence.

This is a developing story that we’re watching unfold and look forward to following!

Prime Day provides insight into 2H 2023 shopping trends

Prime Day, outside of Cyber Monday, is easily one of the most anticipated online shopping “holidays” of the year. Prime Day 2023 fell on July 11th and July 12th and early data suggests that, while sales grew year over year, they fell below the estimates projected by Adobe. It’s worth noting, though, that even though sales fell below estimates, July 11—the first day of Prime Day—was its biggest-ever sales day at Amazon. Although sales reached new levels and helped boost US ecommerce sales overall, there are a few key trends coming out of Prime Day that we anticipate will carry into the remainder of the year, including Holiday 2023. Insights from Insider Intelligence suggest that consumers are focused on finding the best deal by waiting for discounts or comparison shopping, prioritizing household necessities over big-ticket items, and consumers are more open than ever to alternative purchasing methods like Buy Now, Pay Later. And if you love numbers like us, we’ve included a few of their top callouts from Prime Day 2023.

Higher discounts spurred shoppers to spend, although most used the opportunity to stock up on household goods, necessities, and back-to-school purchases rather than big-ticket items.

- Average order spend was up. The average order size ticked up to $54.05, compared with last year’s $52.26, per Numerator. Most households—65%—placed at least two orders; average household spend reached $155.67.

- Home goods, household essentials, and apparel and shoes were top sellers. Nearly three in 10 (28% of) shoppers purchased home goods, while 26% went for essentials and 24% bought apparel and shoes.

- Amazon was the big ecommerce winner. Online sales at retailers not named Amazon fell 7% on the first day of Prime Day compared with 2022, per Salesforce. But some retailers, like Walmart and Target, benefited by holding sales events before and after Prime Day.

Penny pinching: Despite shoppers’ enthusiasm, it’s clear that consumers are still feeling financial pressure.

- Buy now, pay later (BNPL) usage surged during the event. Shoppers used BNPL for 6.5% of ecommerce orders placed on July 11 and 12, a 20% increase year-over-year, per Adobe.

- Consumers are waiting for sales to make purchases. Over half (52%) of shoppers said they held out on purchasing items until they went on sale for Prime Day, according to Numerator.

- Shoppers are comparison-shopping to find the best deal. Fifty-four percent of those who shopped on Amazon for Prime Day compared prices with other retailers—a remarkable change compared with 2021, when only one-third of shoppers did so.

- Looking ahead: Prime Day’s success shows that sales are still a highly effective way to spur consumer spending. But the growing popularity of alternative financing methods like BNPL, as well as the shift away from discretionary categories like electronics in favor of household goods and essentials, underscores the strain that consumers are under.

AdParlor POV:

While it’s clear that consumer shopping trends are shifting, there’s a lot of insight around new opportunities for brands to capitalize. Trends we’ve seen over the last few years will likely remain consistent (i.e. starting promotions earlier), or will be magnified (i.e. Buy Now, Pay Later) but there are a few additional macro trends to help ensure brands stay ahead. For instance, 1. Meet the consumer where they are: provide exceptional customer service across all touch points. According to the Zendesk Customer Experience Trends Report 2023, 64% of shoppers will spend more if their issues get resolved on the channel they’re already using. 2. Lean into Phygital. Provide hyper-personalized shopping experiences combining the best of in-store and online shopping. For example, businesses are increasingly enabling customers to create their own journeys during the shopping experience. This can include things like intelligent dressing rooms that allow consumers to find their sizes virtually or utilizing influencers through live streaming. Companies have reported conversion rates up to 30%, which can be up to 10x higher than conventional ecommerce. Phygital also has many benefits for a business, such as: Boosting Net Promoter Scores® (NPS), strengthening customer loyalty, and gaining more customers.

Hey Alexa, play TikTok Music

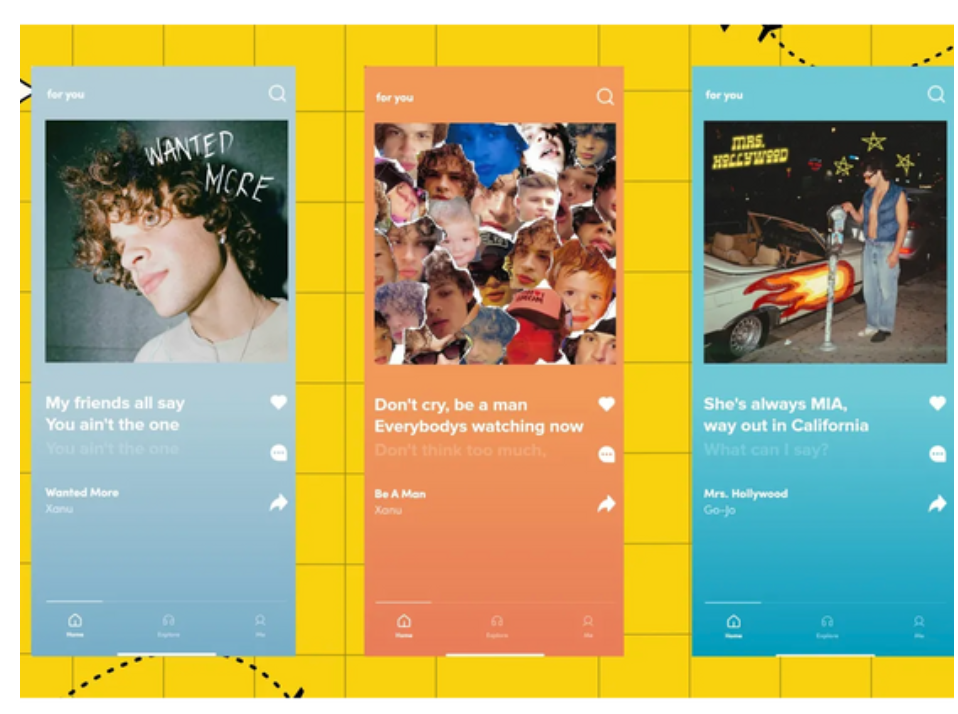

TikTok is rolling out its new subscription-based music streaming platform — aptly named TikTok Music — to new markets, almost two weeks after the service first debuted in Indonesia and Brazil. According to a press release shared with The Verge, TikTok is inviting select users from Australia, Mexico, and Singapore to join a closed beta test that launched on July 19th and provided participants with a three-month free trial for the TikTok Music service.

While TikTok Music has its own dedicated app, the new streaming service can also be linked to a standard TikTok account, allowing users to listen, share, and download music that they discover through the social media platform. Users will also be able to share their favorite TikTok Music tracks and artists with their community on the main TikTok service.

The service includes features that allow users to import their music library, download songs to listen offline, create collaborative playlists, view lyrics in real time, and find tracks by searching for their lyrics. The service also includes a Shazam-like feature to identify songs heard nearby and allows TikTok Music subscribers to leave comments and interact with other users.

AdParlor POV:

It feels like a natural progression that TikTok would officially enter the music space with its own streaming service and the company has confirmed their plan to launch TikTok Music in the US, despite the government’s concerns.

TikTok is already a force to be reckoned with in the music industry. The platform has driven the success of many hit songs since it launched in 2016, helping users discover new artists and tracks through viral trends. Many of these songs are collected into dedicated TikTok playlists on rival streaming services, so it makes sense that TikTok would want to compete with the likes of Spotify, Apple Music, and Amazon Music directly.

The company also has partnerships in place with Sony Music, Universal Music Group, and Warner Music Group to pad out its audio library. From a brand’s perspective, this is a massive opportunity. For years, marketers have utilized musical branding as a key part of their strategic playbooks.

Brands like McDonalds, Pizza Hut and Trident have tapped into music creators on the platform already. According to a study from MRC Data, 65% of TikTokers prefer content from brands that feature original sounds, and 68% remember a brand better when they feature songs they like in their videos.

Check out our Social Media roundup for July:

- Meta Announces New Video Features for Facebook as It Looks to Align With Broader Usage Trends

- Pinterest’s Testing a New System That Would Scan Your Emails to Understand Your Interests

- Twitter Rolls Out Communities Promotion Module for Profiles to All Users

- 13 Surprising Benefits of Snapchat for B2B and B2C Marketing [Infographic]

- Snapchat Shares New Insights Into What Gen Z Consumers Want From Brands

If you are looking to unlock growth and grow your business, we can help! Let’s chat

About AdParlor

AdParlor, an agency established in 2008 and now a division of Fluent (NASDAQ: FLNT), is a leading provider of data-driven digital media strategy and execution that unlocks explosive growth for world-class and disruptive brands. Through our GrowthFuel framework we offer proprietary performance marketing solutions that have scaled our clients’ programs profitably, with our clients’ success being our sole agenda. Our custom technology solves problems related to creative insights, creative production, real time cross-platform reporting and more. Brands choose AdParlor because our unmatched expertise in ecommerce digital media delivers impactful full-funnel performance campaigns for profitable growth.