One of the most frequent questions we are asked is ‘How much will it cost to acquire users for my Facebook game?’ The answer to this question depends on many factors.

A brand new casual game targeting both genders and all ages in Indonesia can pick up tens of thousands of users very quickly, for pennies per user. On the flip side, a poker application with a large existing user base and a laundry-list of permissions, targeting 40-year old American males, can pay several dollars per user. Important background information on the many factors that affect pricing is discussed in our longer report– this post instead examines an interesting sub-topic around user acquisition. We dig deep into the rising cost of user acquisition over the length of a campaign, and why this occurs.

On average, for every 100,000 users you attract to your application via Facebook Ads, you can expect your cost of user acquisition to increase by 10%. Before examining why this happens, we’ll first take a closer look at click-through rates (CTR) and how Facebook makes money on a cost-per-click ad campaign.

CTR and its value to Facebook

If you were to bid and be charged $1 per click with a CTR of 0.01%, you then have an effective cost per thousand users, or CPM, of $0.10 to Facebook. For every 1,000 times Facebook shows your ad, they are only making 10 cents.If you can double that CTR to 0.02%, your ads will have the same value to Facebook,even if you’re paying only $0.50 per click. By increasing your CTR, your ads can be much more valuable to Facebook, allowing you to significantly drop your bid.

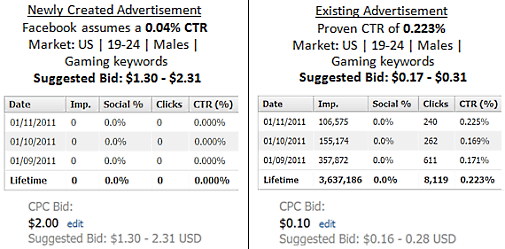

The screenshots below highlight a target market in the US and compare the suggested bid for a new ad versus a proven high CTR ad. In the case of the high CTR ad, we can get a fair amount of clicks even at $0.10!

Why does the cost of user acquisition increase over time?

Once we look at why the cost of user acquisition increases over time, you’ll understand why we started by examining CTR. But first, remember that user acquisition pricing and volume goals go hand-in-hand. For the same application, you may be able to acquire users for $0.30 or $3.00. For the purpose of this discussion, we’re going to assume that the daily volume desired stays consistent – while other factors need to be changed to sustain this volume.

Let’s say we build a brand new city-building game on Facebook application and decide to launch a Facebook Ads campaign. We have several good things going for us. There are a ton of users who are ‘low-hanging fruit’ which we can go after – the subset of hard core Facebook game players who are constantly looking for the hottest new game to play. We can also leverage interest targeting and go after players who are fans of other city-building games. The game and the creative in the ads are brand new, and hopefully spark interest in those users you’re targeting.

Given these favourable conditions, a click-through-rate (CTR) of 0.15% and a conversion rate (CVR) of 65% is very achievable. If you’re willing to pay $0.50 per user given these metrics, you should be able to bring in 15,000 users per day in the prime English speaking countries – US/CA/GB/AU. The question now is, how long can this last?

As you continue your advertising campaigns, a few things are happening. Users are starting to get tired of your ads, despite an attempt to keep refreshing new images and copy. More importantly, the most hard core game players are starting to dry up.

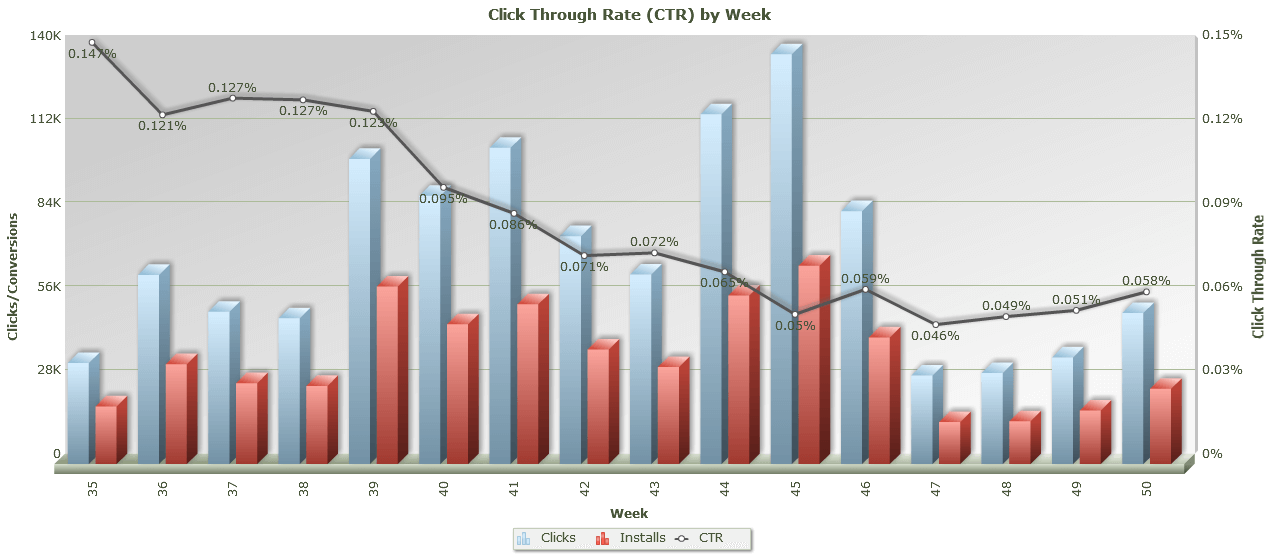

The market of active targetable users who are interested in other city games is starting to diminish, and in order to keep the volume of users up without increasing the rate, we must open up keyword targeting on the users. While these other keywords / interests also work well, the CTR will not be as high as when specifically targeting city-building games. Gradually there’s a drop in CTR across the campaign. (Click the image below for a higher resolution.)

From the anecdote above, we saw the effect a drop in CTR can have on the value of that ad to Facebook. On an aggregate level across our ads, we’re now getting fewer impressions for our same CPC bid. Additionally, the conversion rate (CVR), or the percent of users who end up clicking on allow and entering the game post-click, also begins to drop, having a direct effect on our cost of user acquisition.

As CTR and CVR gradually declines, and if we want to maintain a consistent volume of new users, we eventually have no choice but to increase the price we’re willing to pay per user. Our cost of user acquisition begins to rise roughly at the rate mentioned above – 10% for every 100,000 users we bring on.

Is this always the case?

Every application is different in terms of its appeal and the size of its target market – hence, the speed of its CTR and CVR erosion. With constant refreshing of creatives, an appealing application, and a commitment to finding the target markets that work on a granular level, it’s quite possible to fight off the rising cost of user acquisition. We’ve worked with applications that were able to drive half a million US users at $0.50 within a relatively short period of time, without having to increase the CPI rate. But even in these cases, the market forces eventually win, and in order to sustain volume CPI rates must be increased.